Your Statements now Come Via Text & Email

How It Works

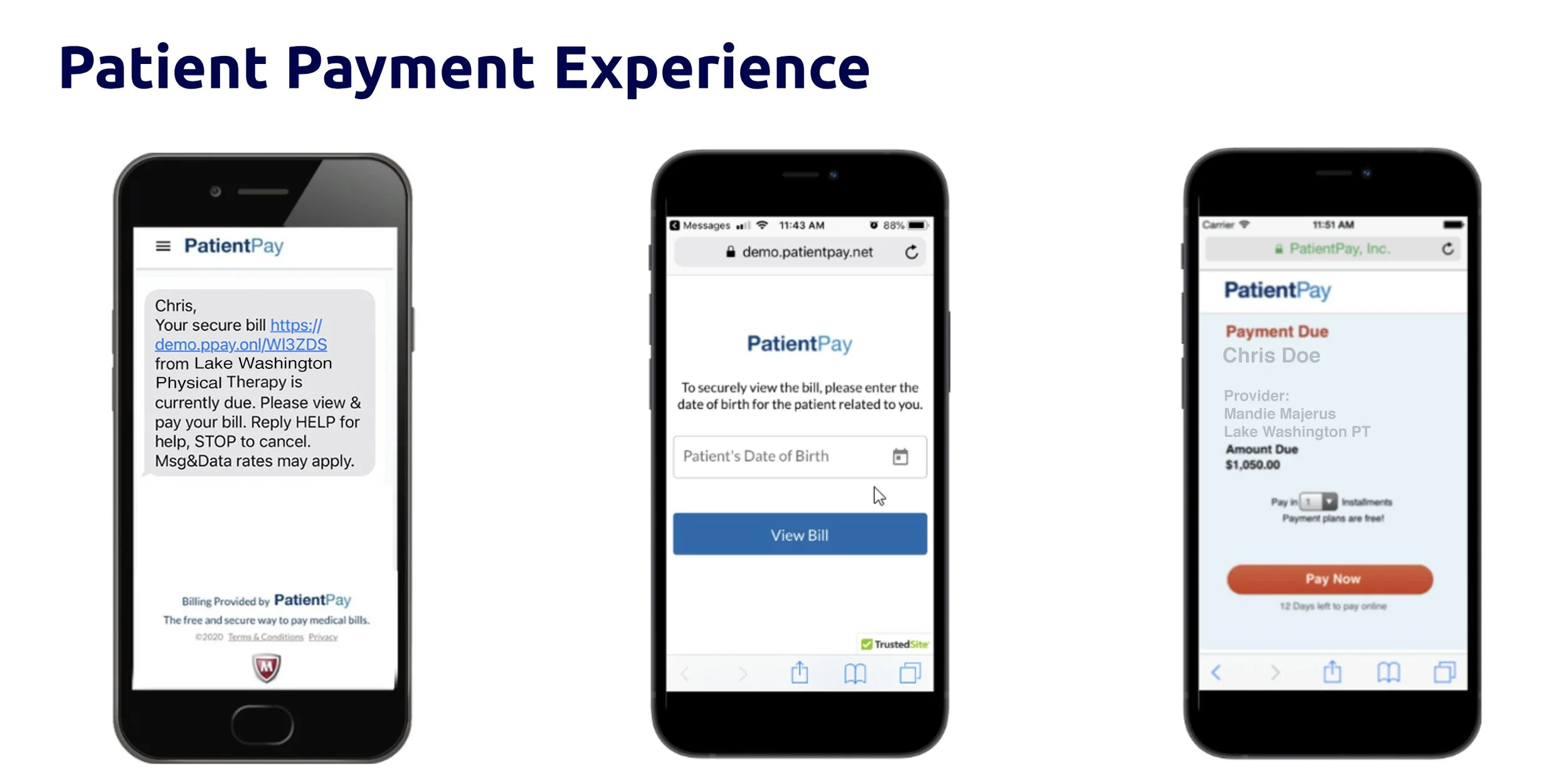

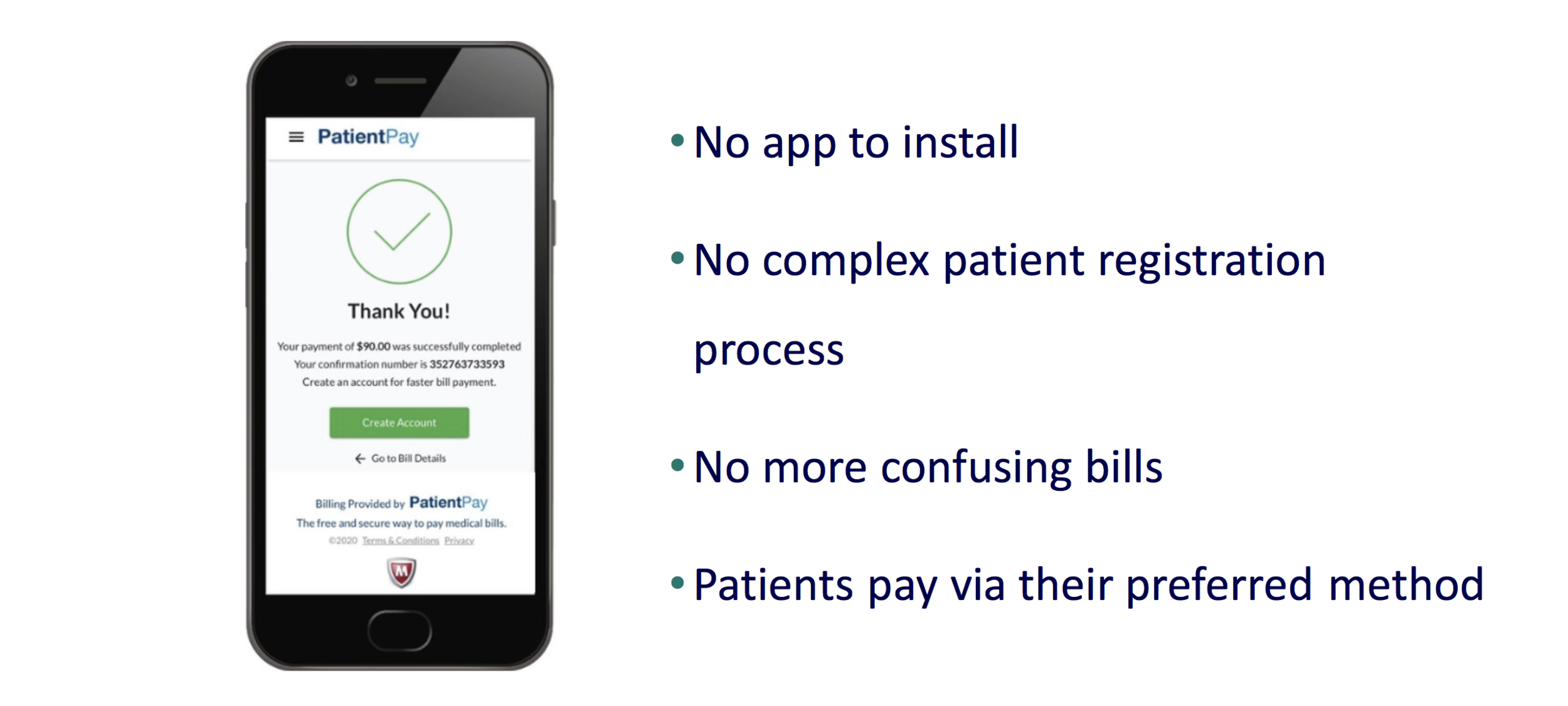

Lake Washington Physical Therapy is excited to roll out the most convenient bill pay technology available in the healthcare space. Convenient bill pay is something that our clients have been asking for and we want to embrace all new technologies that make the overall experience better. LWPT has teamed up with Clinicient & PatientPay to bring you a quick and easy way to take care of your balances. There are no passwords or creating additional log-ins. You simply use your mobile phone via text or your email. PatientPay will ask for the patient’s date of birth (DOB) and bill statement (if using the paper statement). The PatientPay technology complies with all HIPAA regulations and is very simple to use.

Have a payment preference?

We want you to pay the way that is most convenient for you. You have the ability to simply opt out of the messaging you do not want. Our goal is to continue to provide our award winning one-on-one service which is predicated on collecting bills, while not messaging you too frequently. Communication will begin as your insurance payments settles.

Are the Balances Real-Time?

The short answer is no. Please note that online and in-person transactions can take 24-48 hours to be reflected and posted in this process. If you have just paid in-clinic or online the systems must have completed communication and banks must settle the transactions fully before balances are updated. Meaning you could have paid the night before an appointment and when checking in at your next visit it may still show a balance. Just simply communicate this to the front when signing in.

Please have your paper statement in hand for the log in code.

Questions

Call our centralized Billing Phone Number

1.866.451.7596

FAQS

I have a question about my bill?

You can reach us at our billing office 1.866.451.7596

Can I still pay my balance in person?

Yes, We will still have the ability to take checks, cash, and credit cards onsite as we have always done

Can I call in and pay my balance?

Yes, This option is still available to clients that would like to take care of this over the phone

How frequent will Patient Pay be contacting me about my bill?

PatientPay will be sending you a text introduction upon your first balance due, a reminder text/email, and a past due text/email. All messaging gives you the ability in just a few clicks to complete the payment of your balance.

What about my insurance payment?

PatientPay only gets the client balances that have been processed by your insurance first and have been passed on after contractural rates as “Patient Responsibility”

Will I still get a paper bill?

Yes, clients will still get paper statements

Can I start a payment plan?

With PCI level 1 security you can establish a payment plan with card on file. Patient Pay will send you a notice prior to your charging of the card.

Can I get a print out of my bill?

Yes, you can log-in to the PatientPay portal and download your bill or take a screen shot. You will get an email of the bill being paid as well that you can keep your for you medical records or year-end tax planning.

How quickly will my balance update?

This typically takes about 48 hours for the credit card funding process to complete. Your PatientPay balance will give you confirmation but the banking process and the posting of payment will take longer.

Can I opt out of text messaging

Yes, by texting back STOP. You will still receive paper and email balance communication. As soon as you no longer have a balance all messaging stops.

Insurance Term Glossary

Explanation of Benefits (EOB) - A claims statement that is sent whenever you use your health plan for services or products from a healthcare provider. It shows how your benefits cover the cost of a service from your provider and what you owe. The EOB is not a bill.

Service/Product - The type of services or products you received from your provider.

Dates of Service - The date(s) you received service.

Amount Billed - The full amount billed by your provider to your health plan.

Your Plan Discounts & Payments - This section details the amounts that you do not need to pay.

Network Discount - The amount you save by using a provider that belongs to an Insurance network. Insurance payers negotiate lower rates with its in-network providers to help you save money.

Amount Paid By Your Health Plan - The portion of the charges eligible for benefits minus your copay, deductible, coinsurance, network discount and amount paid by another source up to the billed amount.

Amount Paid By Another Source - Examples of other sources include: a health funding account, other health insurance, automobile insurance, homeowners' insurance, disability insurance, etc. This amount may not be itemized and may only show in the Totals row of the Claim Detail.

Copay - A set amount by your insurance plan that you pay for certain covered services such as office visits or prescriptions. Copays are usually paid at the time of service.

Deductible - Your deductible is the amount you need to pay each year for covered services before your plan starts paying benefits.

Coinsurance - A percentage of covered expenses that you pay after you meet your deductible.

Amount Not Covered - The portion of the amount billed that was not covered or eligible for payment under your plan. Examples include charges for services or products that are not covered by your plan, duplicate claims that are not your responsibility, amount related to not getting a pre-approval for service, and any charges submitted that are above the maximum amount your plan pays for out-of-network care.

Your Total Responsibility - This section details the portion of the bill that is your responsibility to pay. This amount might include your copay, deductible, coinsurance, any amount over the maximum reimbursable charge, or products/services not covered by your plan. If you received payment intended for a provider, it is your responsibility to pay the provider.